Single Touch Payroll (STP) is the ATO’s digital reporting system that requires employers to report wages, PAYG withholding and superannuation every time they pay their staff. Since the introduction of STP Phase 2, employers must now report more detailed payroll information to ensure government agencies receive accurate, real-time data.

At Indigo Bookkeeping, we help businesses stay compliant and confident with their payroll obligations.

What Is STP and Why Does It Matter?

STP integrates directly into your payroll software. Each time you process a pay run, the system sends the ATO key information about your employees, including:

Wages, overtime, bonuses and other income

PAYG withholding

Superannuation

Employee tax treatment and employment basis (full-time, part-time, casual etc.)

Allowances and leave types

Termination details, including separation reasons

Child support deductions or garnishees, if applicable

This replaces end-of-year payment summaries and ensures employee records remain accurate throughout the year.

What Employees See

Once payroll is reported through STP:

Employees can view their year-to-date earnings and super on myGov at any time

Their Income Statement replaces the old payment summary

Their tax return can be prepared using this information once it is marked “Tax Ready”

This gives employees greater transparency and reduces end-of-year delays.

What Employers Need to Do

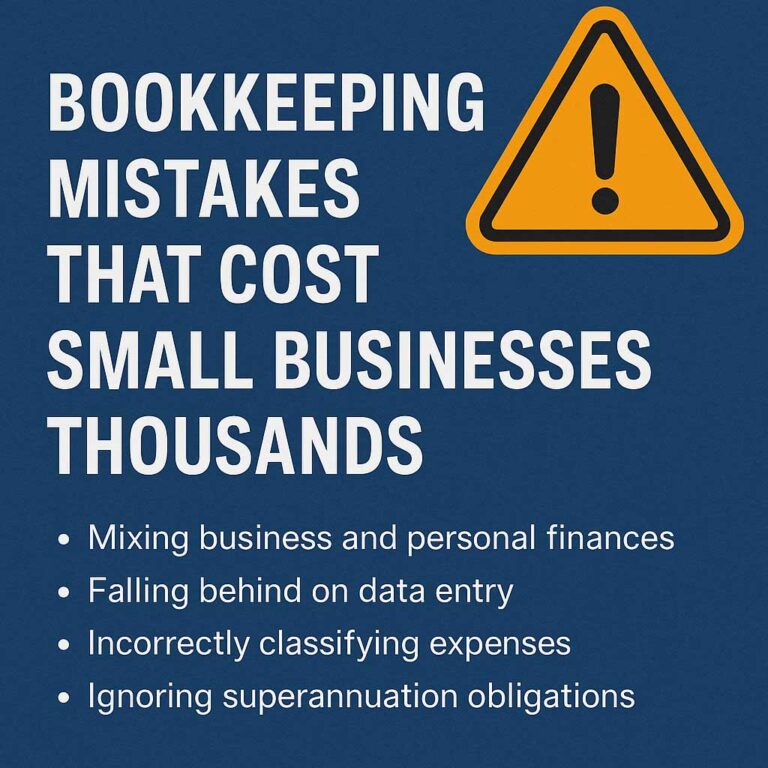

To meet your obligations, you must use STP-enabled payroll software that is compliant with Phase 2 reporting. Your payroll information must be correct and up to date, including:

Employee details (TFN, DOB, address)

Employment basis (full-time, part-time, casual, labour hire etc.)

Accurate categorisation of allowances, leave, bonuses and directors’ fees

Correct superannuation calculations

Proper reporting of termination payments

Getting these details wrong can cause ATO discrepancies, incorrect employee tax outcomes or superannuation compliance issues.

Common Challenges We See

Many businesses need help with:

Incorrect income type setup (closely held, working holiday makers, labour hire)

Allowances not reported using Phase 2 categories

Termination payments and ETP codes

Child support obligations not linked correctly in payroll

Superannuation not matching STP reporting

Errors in employee tax treatment codes

These issues are extremely common—and all fixable with the right guidance.

How Indigo Bookkeeping Can Help

As registered BAS Agents, we support employers with all aspects of STP, including:

Setting up or correcting STP Phase 2 in your software

Running ongoing payroll and lodging each STP pay event

Reviewing your payroll structure for accuracy and compliance

Preparing and lodging STP finalisation at year-end

Assisting with correct reporting of terminations and ETPs

Reconciling superannuation and clearing house payments

Applying for ATO deferrals if you’re transitioning to new software

Liaising with the ATO on your behalf when issues arise

Our goal is to ensure your payroll is correct, compliant and stress-free.

Need Support With STP?

STP is now a core part of every employer’s compliance obligations—and having the right setup makes all the difference.

If you’d like help with payroll, super, or ongoing STP management, the Indigo Bookkeeping team is here to make the process simple and accurate.

Let Indigo do the dirty work… and keep your payroll running smoothly.

Need Expert Help?

Navigating new payroll systems can be complex, but Indigo Bookkeeping is here to help. As registered tax and BAS agents, we can:

- Set up your STP reporting from scratch

- Manage your ongoing STP obligations

- Liaise with the ATO on your behalf

- Help you choose and implement suitable software solutions

Get in touch with Indigo Bookkeeping to ensure your business remains compliant—and efficient—under the STP regime.