Good record keeping is more than just a best practice—it’s a legal obligation for Australian businesses. Whether you’re a sole trader, partnership, or company, the ATO expects you to maintain accurate, complete records for every financial transaction. At Indigo Bookkeeping, we help businesses stay compliant, organised, and audit-ready.

Here’s what you need to know.

Why Record Keeping Matters

Record keeping isn’t just about tax time. Well-maintained records help you:

- Track the health of your business

- Make informed financial decisions

- Claim all eligible deductions

- Avoid ATO penalties or audits

Legal Requirements: What the ATO Says

The Australian Taxation Office (ATO) requires businesses to:

- Keep records for at least five years

- Ensure records are in English or easily converted to English

- Make records accessible and legible on request

What Records You Must Keep

Depending on your business type and structure, you may need to keep records such as:

1. Sales and Income

- Tax invoices

- Receipts or dockets

- Cash register tapes and bank deposit books

- Records of online sales

2. Purchases and Expenses

- Purchase receipts and supplier invoices

- Credit card statements

- Petty cash records

- Logbooks for vehicle use

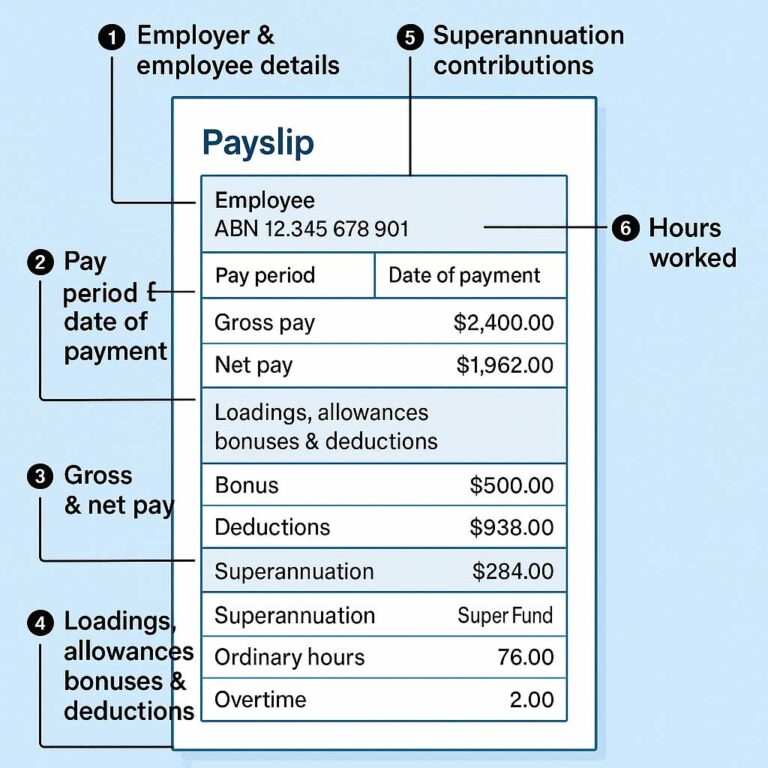

3. Employee and Contractor Records

- Payslips and payroll summaries

- Superannuation contributions

- Tax file number declarations

- Work hours and leave entitlements

4. Bank Records

- Statements for business accounts

- Loan agreements

- Merchant account summaries (e.g. EFTPOS, PayPal)

5. Asset and Depreciation Records

- Asset purchase records

- Depreciation schedules

- Insurance valuations

6. GST and BAS Records

- BAS lodgements

- GST calculations and payment evidence

Digital or Paper? Both Are Fine—With Conditions

You can store records electronically or in paper form, but they must be:

- Securely stored

- Accurately reproduced (e.g., scans must be clear and unchanged)

- Backed up regularly (especially if using cloud systems)

Penalties for Non-Compliance

Failing to meet record-keeping obligations can result in:

- ATO penalties

- Interest charges on unpaid tax

- Difficulty defending yourself in the event of an audit

Indigo Bookkeeping Can Help

We don’t just do books—we build compliance into your business. With Indigo Bookkeeping, you get:

- Cloud-based tools like Xero or MYOB

- Digitally organised records

- BAS-ready reporting

- Peace of mind at tax time

Need help with your record-keeping systems?

Contact Indigo Bookkeeping today—we’ll help you build a system that works for your business, not just the ATO.