When you’re running a small business, it’s easy to let the books fall to the bottom of your to-do list. But poor bookkeeping can lead to expensive mistakes—missed deductions, unpaid tax bills, cash flow crises, or even ATO audits.

At Indigo Bookkeeping, we’ve seen how avoidable errors can cost small business owners thousands. Here are the most common (and costly) bookkeeping mistakes—and how to avoid them.

1. Mixing Business and Personal Finances

It might seem convenient to use the same account for everything, but it’s a disaster for your books. Mixing personal and business transactions makes it hard to track expenses, calculate profit, and claim deductions.

Tip: Open a separate business bank account (and credit card) from day one.

2. Falling Behind on Data Entry

Neglecting to record sales, expenses, or receipts in real time creates gaps, confusion, and often tax reporting errors. By the time you try to fix it, you’ve forgotten the details—or lost the receipts entirely.

Tip: Set aside time weekly (or outsource to a bookkeeper) to keep your records up to date.

3. Incorrectly Classifying Expenses

A meal with a client is different from lunch at your desk—and the ATO knows the difference. Misclassifying expenses can lead to over-claiming or under-claiming deductions, which affects your tax bill.

Tip: Use accounting software with proper chart of account categories—and get advice on tricky items.

4. Not Reconciling Bank Accounts

Bank reconciliation compares your internal records to your actual bank statements. Skipping it can mean duplicated entries, missed payments, or cash flow that looks better (or worse) than it is.

Tip: Reconcile your accounts monthly, or let Indigo Bookkeeping do it for you.

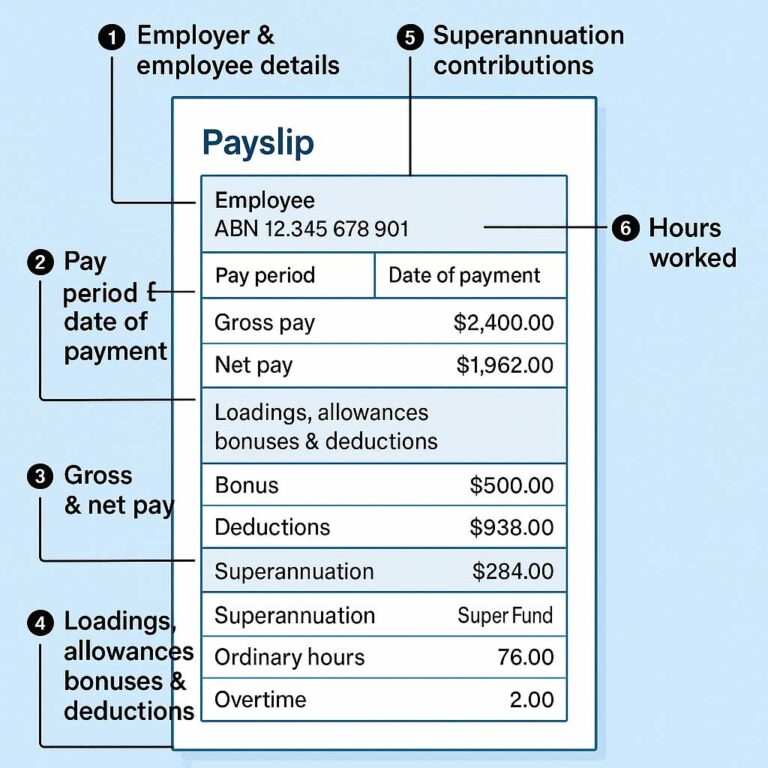

5. Ignoring Superannuation Obligations

Missing super payments or paying them late can lead to the Superannuation Guarantee Charge—a penalty that includes interest and admin fees. You can’t claim it as a deduction either.

Tip: Pay super on time and through a compliant clearing house.

6. DIYing Without the Right Tools or Knowledge

Using a spreadsheet or old-school manual ledger is risky unless you’re experienced. Many small business owners overestimate their ability to handle payroll, BAS, and GST reporting—leading to mistakes that snowball.

Tip: Invest in proper bookkeeping software (like Xero or MYOB), and get expert training early on.

7. Not Backing Up or Securing Your Data

Losing access to your financial records due to a computer crash, theft, or cyberattack can be devastating. If your records aren’t retrievable, you could face penalties from the ATO.

Tip: Use cloud-based software with automatic backups and encryption.

Let Indigo Bookkeeping Help You Avoid These Mistakes

We know running a business is demanding—and you didn’t start yours to do paperwork. Indigo Bookkeeping takes the pressure off with accurate, professional bookkeeping tailored to Australian compliance standards.

- Stay on top of BAS, super, and payroll

- Avoid fines and keep your books audit-ready

- Understand your finances and plan with confidence

Stop making costly mistakes. Start getting it right. Contact Indigo Bookkeeping today for a free consultation.