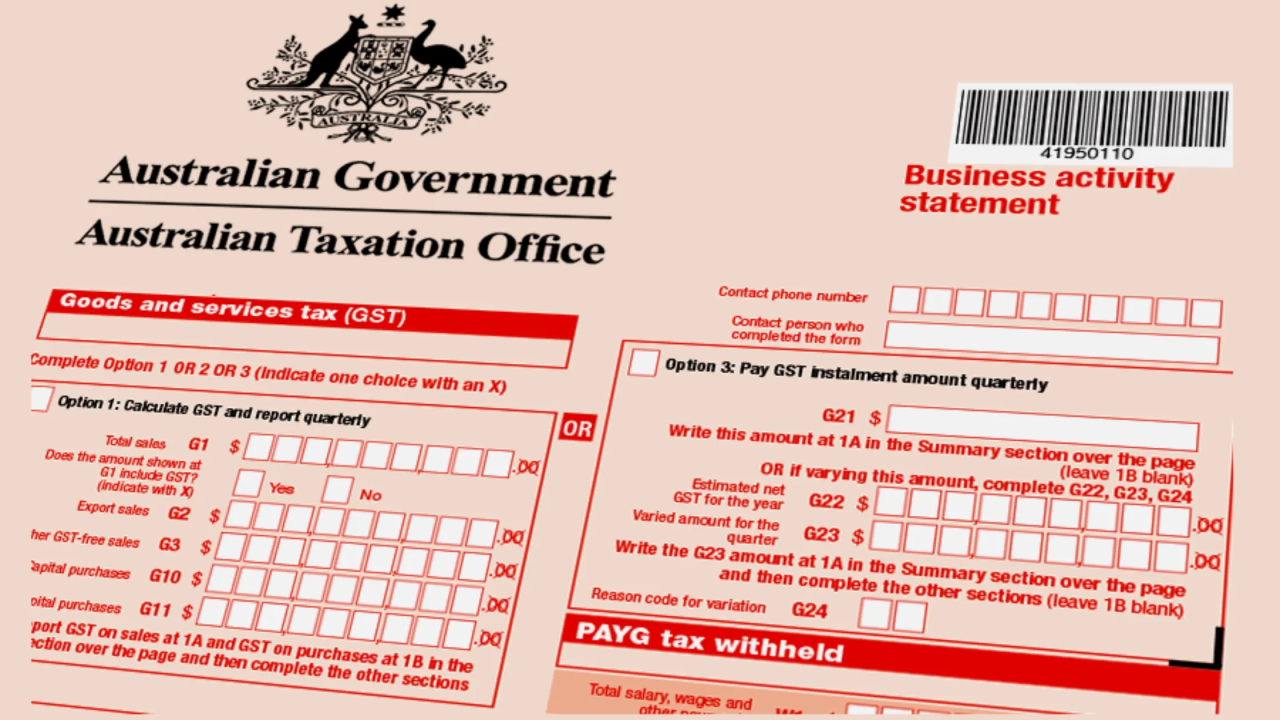

If your business is registered for GST in Australia, lodging a Business Activity Statement (BAS) is a regular and essential part of staying compliant with the ATO. Whether you’re new to business or need a refresher, here’s everything you need to know—written in plain English.

What Is GST?

Goods and Services Tax (GST) is a 10% tax on most goods and services sold in Australia. While consumers ultimately pay the tax, businesses are responsible for collecting it on behalf of the Australian Government and passing it on to the Australian Taxation Office (ATO).

GST is built into the final price of most purchases. When a business sells goods or services, it collects GST from the customer, keeps track of what’s collected, and then reports and pays that amount to the ATO—after subtracting any GST paid on business purchases (input tax credits).

What Is a BAS?

A Business Activity Statement (BAS) is the form you submit to the ATO to report and pay:

- GST collected on sales

- GST paid on business purchases

- PAYG (Pay As You Go) withholding tax from employee wages

- PAYG instalments (if applicable)

- Other business taxes and credits

Once you’re registered for GST, the ATO will automatically send you a BAS when it’s time to lodge.

How Does BAS Work?

Your BAS calculates how much you owe the ATO using this basic formula:

GST on sales – GST on purchases + PAYG withholding + PAYG instalments = Amount payable (or refundable)

To complete your BAS correctly, you’ll need accurate records of:

- Total sales for the period

- GST collected from customers

- GST paid on business purchases and expenses

- Wages paid and tax withheld from staff

- Other income and expenses relevant to your business

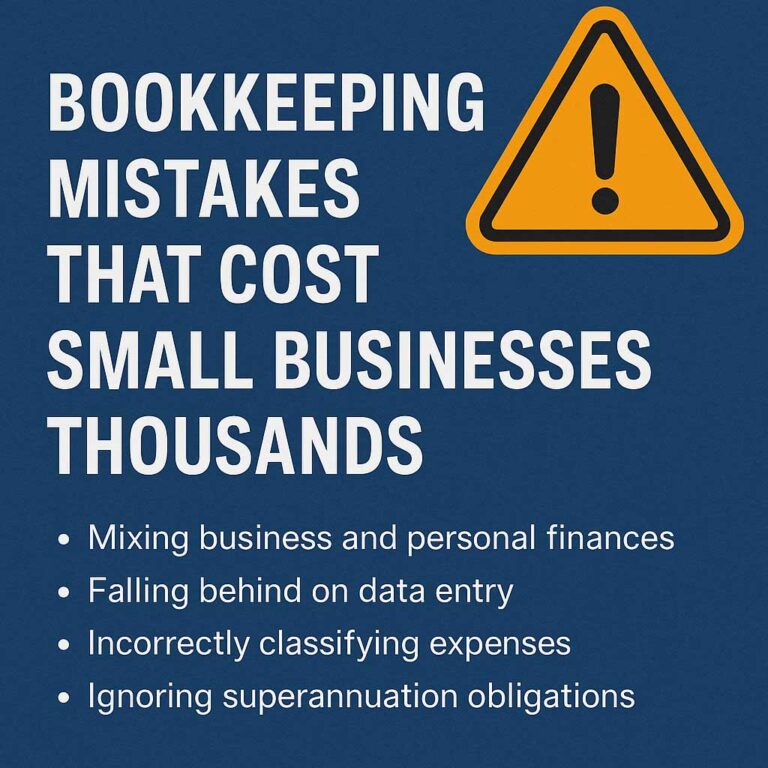

Important: You can only claim GST credits on the business portion of an expense. For mixed-use purchases (e.g. part business, part personal), claim only the business-related GST.

How Often Do You Lodge a BAS?

The frequency of your BAS lodgement depends on your GST turnover:

| GST Turnover | Reporting Frequency |

|---|---|

| $20 million or more | Monthly (mandatory) |

| Less than $20 million | Quarterly (default) |

| Less than $75,000 (or $150,000 for non-profits) | Annually (voluntary) |

Tip: Depending on your circumstances, you can change the cycle you use to report and pay GST. This may happen when your GST turnover changes or if you choose to report and pay using a different cycle.

When Is BAS Due?

Your BAS due date depends on how you lodge:

- Paper BAS: Due on the date listed on the form

- Electronic BAS: You may receive an automatic extension

- If the due date falls on a weekend or public holiday, you can lodge and pay on the next business day

Natural disasters and other unforeseen events can impact BAS due dates. A registered BAS or tax agent can request extensions or lodgement variations on your behalf if needed.

Tips for Completing Your BAS

- Report whole dollar amounts only (omit cents)

- Include each sale or purchase once only

- If using cash basis accounting, include sales and purchases in the period you received or paid for them

- If a section of the BAS doesn’t apply to your business, enter a zero, don’t leave it blank

- You can amend prior BAS submissions if you find an error

Use accounting software like Xero, MYOB, or QuickBooks to automatically generate accurate BAS reports. This can save hours of manual work and reduce the risk of errors.

Lodging Your BAS

You have several options for lodging your BAS:

1. Online via the ATO Business Portal

Businesses with an ABN can lodge directly online.

2. Through MyGov (for sole traders)

Sole traders can lodge via their linked myGov account.

3. Directly from accounting software

If your software is SBR-enabled (Standard Business Reporting), you can lodge directly with just a few clicks.

4. Using a BAS or Tax Agent

A BAS or tax agent can:

- Lodge on your behalf

- Adjust prior BAS errors

- Provide advice and ensure you’re claiming everything you’re entitled to

We offer fixed-price BAS services bundled with our bookkeeping, helping you save time, money, and avoid ATO penalties.

5. By mail (paper BAS)

You can request a paper BAS by calling 13 28 66, but this method:

- Has earlier deadlines

- Involves more admin

- Can strain your cash flow by forcing earlier payments

Why Many Businesses Outsource BAS Lodgement

Running a business is time-consuming—and mistakes in BAS can cost you. Many of our clients choose to outsource their bookkeeping and BAS preparation to us because:

- They’re too busy to keep up with record keeping

- They want to avoid ATO penalties and errors

- They need accurate, up-to-date financial data to grow their business

💬 “Outsourcing BAS is one of the smartest things a small or medium business can do—it frees up your time and gives you peace of mind.”

Final Thoughts

Your BAS is more than a compliance obligation—it’s a valuable tool for understanding your business’s cash flow, tax obligations, and performance. Whether you lodge monthly, quarterly, or annually, accurate records and smart systems will save you time, stress, and money.

Need help with your BAS or bookkeeping?

We offer affordable, fixed-fee packages that combine BAS lodgement, bookkeeping, payroll all under one roof.

Contact us today for a free quote and take the hassle out of BAS.