For every business with employees, issuing accurate and compliant payslips isn’t just good practice—it’s a legal requirement. At Indigo Bookkeeping, we know that small errors can lead to big consequences. Here’s what you need to know to ensure your payslips meet Australian standards.

Why Payslips Matter

Payslips provide employees with a clear record of their earnings, tax, and superannuation contributions. They also serve as vital documentation in the event of workplace disputes or Fair Work audits.

Legal Requirements for Payslips

According to the Fair Work Act 2009, employers must provide payslips to employees:

- Within one working day of payday, even if the employee is on leave

- Electronically or in hard copy, as long as it’s easily accessible

Each payslip must include specific information to be compliant.

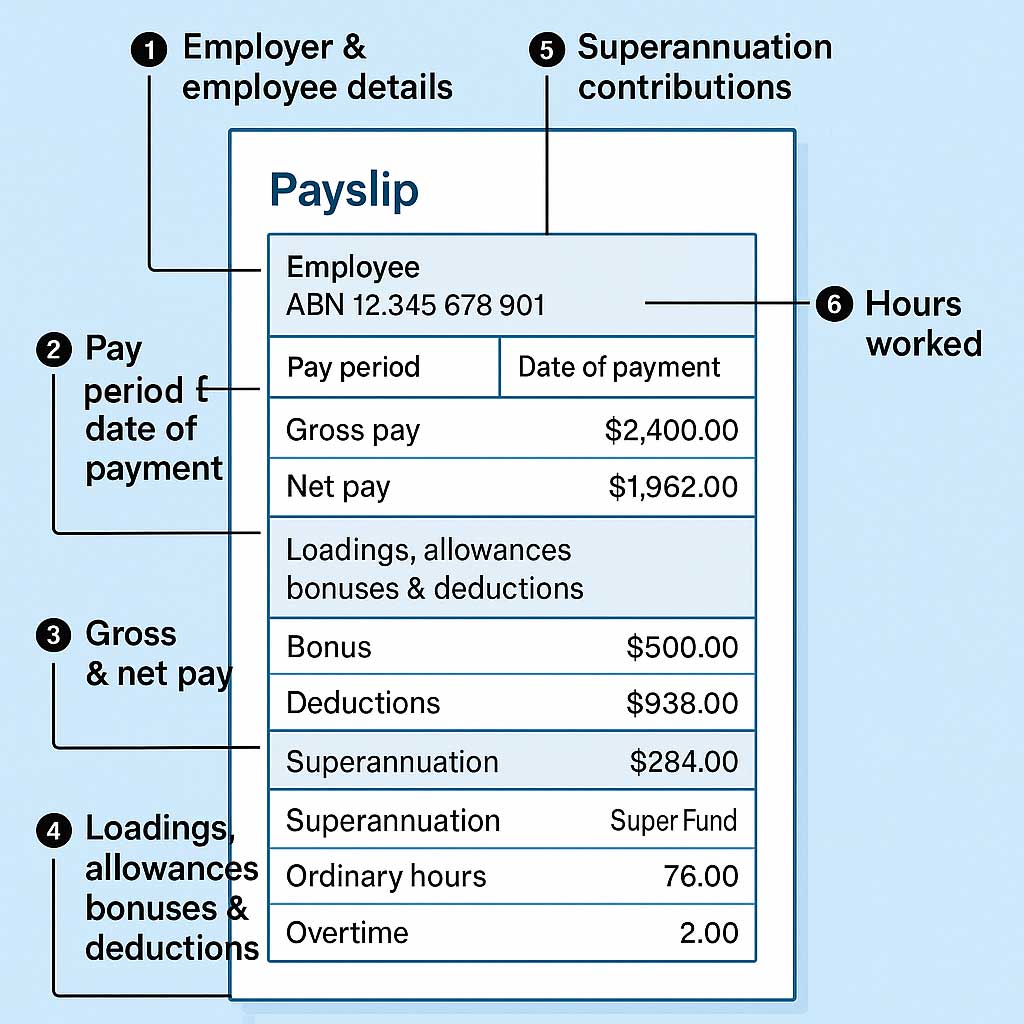

What to Include on a Payslip

A compliant Australian payslip must show:

1. Employer & Employee Details

- Employer name and ABN (if applicable)

- Employee name

2. Pay Period & Date of Payment

- The period the payment covers

- The actual date of payment

3. Gross & Net Pay

- Gross amount before tax

- Net amount after deductions

4. Loadings, Allowances, Bonuses & Deductions

- Any separately identifiable payments (e.g. overtime, weekend loading)

- Deductions (e.g. salary sacrifice, union fees) and who they were paid to

5. Superannuation Contributions

- Super guarantee amount

- Name and/or number of the super fund

6. Hours Worked

- Ordinary hours worked and pay rate

- Any penalty or overtime hours worked

Common Mistakes to Avoid

- Missing details – Omitting even one required item could lead to penalties

- Manual payslips – Using software ensures calculations are accurate and compliant

- Incorrect super calculations – Double-check minimum super guarantee rates (currently 12% as of July 2025)

Why Use Indigo Bookkeeping?

We understand that payroll compliance can be overwhelming. At Indigo Bookkeeping, we:

- Set up compliant payroll systems

- Prepare payslips using trusted accounting software

- Ensure you’re always up to date with Fair Work requirements

Let us take the stress out of payroll so you can focus on running your business.

Need help with payroll compliance?

Contact the team at Indigo Bookkeeping today—we’ll keep your payslips compliant and your business protected.