If you’re running a business in Australia and registered for GST (Goods and Services Tax), issuing tax invoices correctly is not just good practice—it’s a legal requirement. As bookkeepers, we regularly guide clients on how to stay compliant with ATO (Australian Taxation Office) standards, and ensuring tax invoices meet the necessary criteria is a key part of that.

What Is a Tax Invoice?

A tax invoice is a document issued by a seller to a buyer that outlines the goods or services sold, along with the amount of GST payable. It’s a crucial record for both parties: the supplier to show GST collected, and the buyer to claim GST credits (if they’re also registered for GST).

When Is a Tax Invoice Required?

You must issue a tax invoice when:

- You make a taxable sale of $82.50 (including GST) or more.

- Within 28 days of your customer requesting one, and you’re registered for GST

Without a valid tax invoice, your customer generally can’t claim a GST credit—even if they paid GST on the sale.

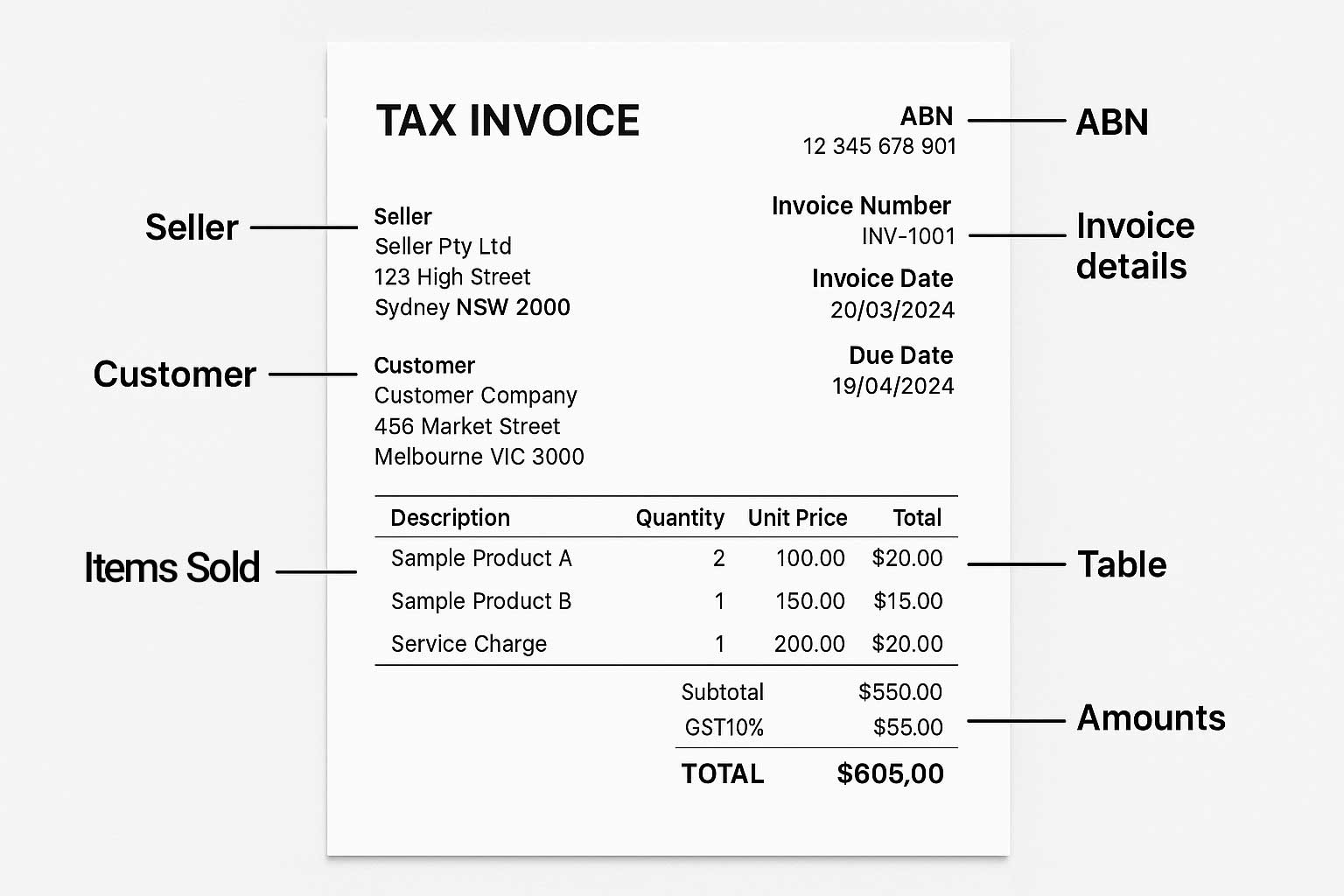

Mandatory Components of a Tax Invoice

To meet ATO standards, a tax invoice must include specific details, depending on the total sale amount.

For sales less than $1,000 (including GST):

Tax invoices for taxable sales of less than $1,000 must include enough information to clearly determine the following 7 details:

- Document is intended to be a tax invoice.

- Seller’s identity.

- Seller’s Australian business number (ABN).

- Date the invoice was issued.

- Brief description of the items sold, including the quantity (if applicable) and the price.

- GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly 1/11 of the total price, as a statement which says, ‘Total price includes GST.’

- Extent to which each sale on the invoice is a taxable sale.

For sales of $1,000 or more (including GST):

In addition to the above, the invoice must also include:

- The buyer’s identity or ABN.

Format Tips and Best Practices

- Number your invoices: A sequential invoice number helps with tracking and audit purposes.

- Use clear language: Make it easy to identify GST components (e.g., “Total including GST”).

- Keep digital records: Electronic invoices are acceptable and often more efficient to store and retrieve.

Special Cases

- Simplified tax invoices can be used for low-value sales under $82.50.

- Recipient-created tax invoices (RCTIs) are used when the buyer issues the invoice—common in specific industries like agriculture and government contracts, but only permitted under strict ATO guidelines.

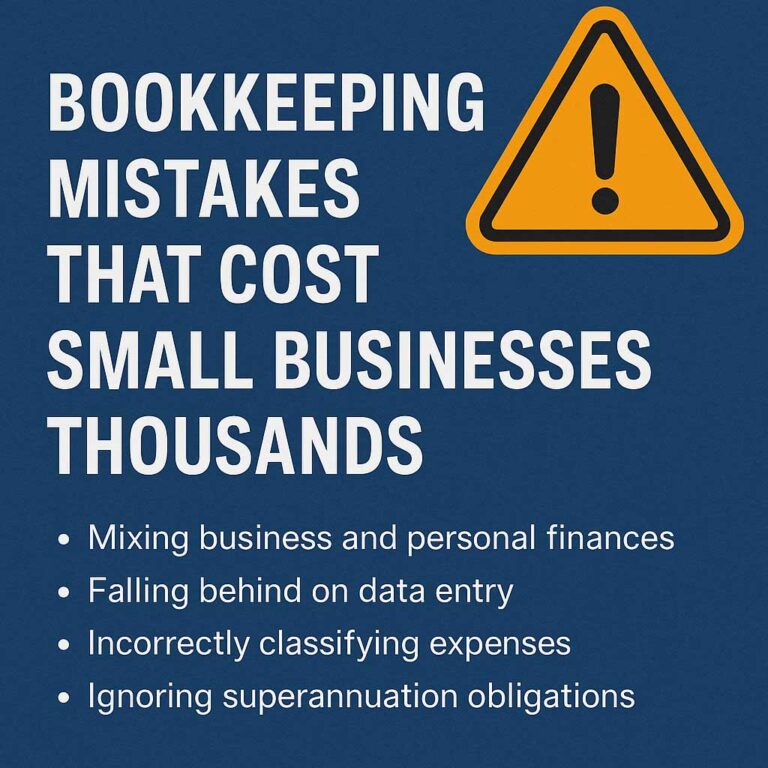

Common Mistakes to Avoid

- Your invoice format is not clear that it is intended to be a tax invoice.

- Leaving out your ABN or issuing invoices when not registered for GST.

- Not specifying whether GST is included or separating it incorrectly.

- Using vague descriptions of goods or services.

Why Accurate Tax Invoicing Matters

Incorrect or incomplete tax invoices can lead to:

- Delayed or denied GST credits for your clients.

- ATO penalties or audit flags.

- Disruption in cash flow due to invoice disputes.

Need Help?

Here at Indigo Bookkeepers, we help businesses stay compliant and stress-free when it comes to tax obligations. Whether you’re setting up your invoicing system, reviewing your existing process, or preparing for BAS, we can assist.

Contact us today to make sure your invoicing is up to ATO standards—accurate, efficient, and audit-ready.