5 Signs It’s Time to Hire a Bookkeeper

As a business owner, you wear many hats. You’re the visionary, the marketer, the sales guru, and often, the chief everything officer. But somewhere in that whirlwind, the essential task of bookkeeping can become a daunting chore, easily pushed to the back burner. If you find yourself nodding along to any of these signs, it’s […]

Bookkeeping Mistakes That Cost Small Businesses Thousands

When you’re running a small business, it’s easy to let the books fall to the bottom of your to-do list. But poor bookkeeping can lead to expensive mistakes—missed deductions, unpaid tax bills, cash flow crises, or even ATO audits. At Indigo Bookkeeping, we’ve seen how avoidable errors can cost small business owners thousands. Here are […]

Record Keeping Requirements in Australia

Good record keeping is more than just a best practice—it’s a legal obligation for Australian businesses. Whether you’re a sole trader, partnership, or company, the ATO expects you to maintain accurate, complete records for every financial transaction. At Indigo Bookkeeping, we help businesses stay compliant, organised, and audit-ready. Here’s what you need to know. Why […]

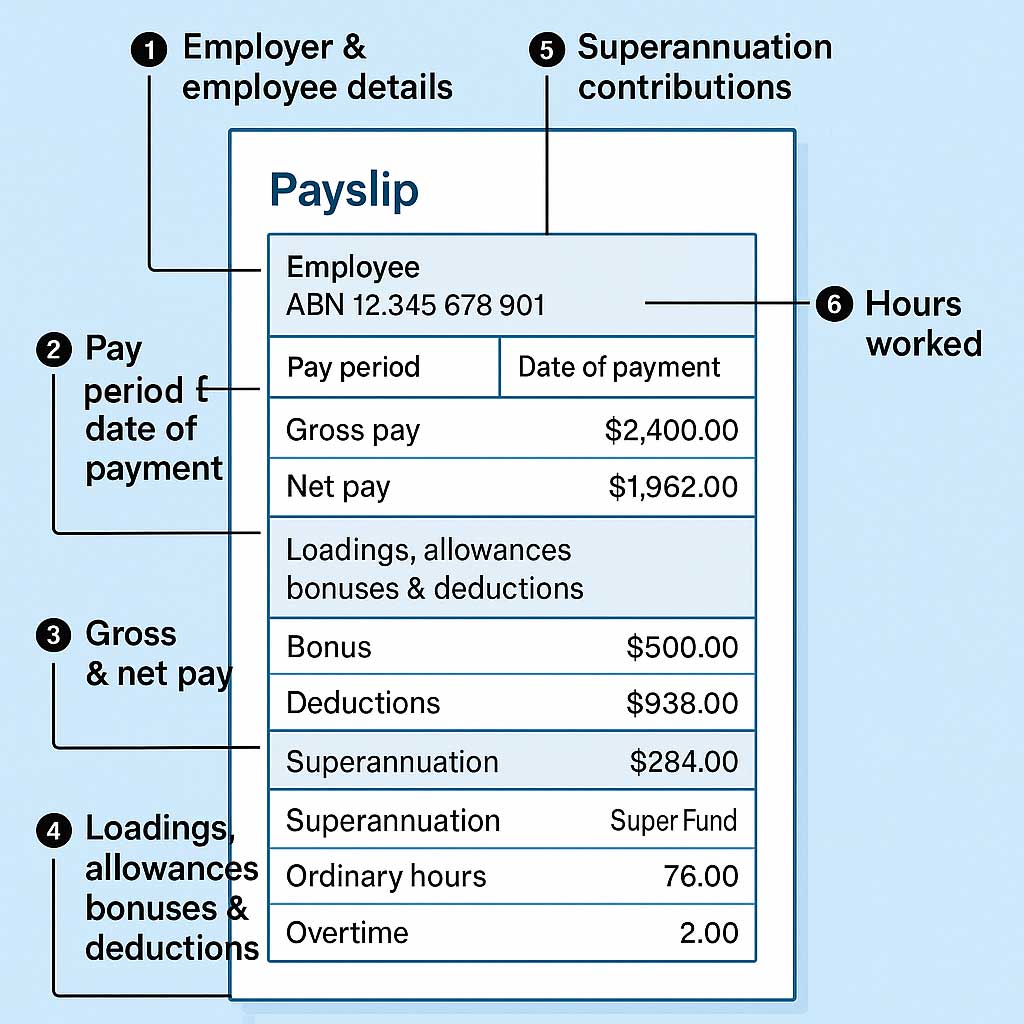

Understanding Payslip Requirements in Australia

For every business with employees, issuing accurate and compliant payslips isn’t just good practice—it’s a legal requirement. At Indigo Bookkeeping, we know that small errors can lead to big consequences. Here’s what you need to know to ensure your payslips meet Australian standards. Why Payslips Matter Payslips provide employees with a clear record of their […]

Tax Invoices – What’s Required

If you’re running a business in Australia and registered for GST (Goods and Services Tax), issuing tax invoices correctly is not just good practice—it’s a legal requirement. As bookkeepers, we regularly guide clients on how to stay compliant with ATO (Australian Taxation Office) standards, and ensuring tax invoices meet the necessary criteria is a key […]